Did you know that thousands of property investors forgo thousands of dollars each year in unclaimed depreciation?

Capital allowance and tax depreciation is a complicated area, and most people simply realise they are entitled to many more legitimate deductions on their rental property than those they claim.

Fortunately, capitalising on these untapped sources of tax savings is a simple as engaging a professional to assess your property for depreciation potential – with the help of a tax depreciation expert you can even retrospectively claim benefits you may have missed out on over previous years.

Here is a basic guide to depreciation below:

What is property depreciation?

Property depreciation correct terminology is Capital Allowance and Tax Depreciation which are tax deductions. They are available to property investors to account for the ageing and ‘wearing out’ of a property and its included assets.

Although the overall value of an investment property may appreciate (increase in overall value over time), the property’s physical assets lose value as they age. For example, five-year-old roof tiles are not considered to have the same dollar value today as when they were bought brand new.

Five-year-old carpet is not regarded as having the same value now as it did when purchased, and the same goes for hot water systems, cooktops, air conditioners, garages and so on.

For accounting purposes, a five-year-old house cannot hold the same value as it did when it was constructed five years ago, because each component of it has aged five years.

The dollar amount by which the value of the building and its included assets decline each year is claimable by the investor as a tax deduction.

The rates for asset depreciation, accepted methodologies and allowable deductions are determined by the Australian Tax Office (ATO) in relevant legislation.

Depreciation of the building, and the assets within a property, are categorised as either Division 43 or Division 40 assets. A description of both allowances follows below.

How to calculate property depreciation?

Property depreciation can be calculated according to two different methods, the Diminishing Value method, and Prime Cost method.

A quality report prepared by a qualified quantity surveyor, such as Capital Claims Tax Depreciation, will report both methods of depreciation for the full ‘depreciable’ life of the property.

This enables the investor to use the method that best suits their tax and investment circumstances.

An investor selects which method they will use when they first apply the depreciation results and must then continue to use the same method for the remainder of the life of the investment.

It is up to the investor, often with the advice of their accountant, to apply whichever strategy is most appropriate to their circumstances.

Factors to consider include projected future annual incomes, the diminishing value and opportunity cost of cash today versus future cash, and future use of the property. Descriptions of each method follows.

Diminishing Value Method

The Diminishing Value method of depreciation applies the nominated depreciation rate, continually, to the written-down value of the asset each year.

The formula for depreciation using the diminishing value method is:

Base value X (days held/365) X (200%/asset’s effective life).

Days held can be 366 for a leap year.

If you started to hold the asset before 10 May 2006, the formula for diminishing value method is: Base value X (days held/365) X (200%/asset’s effective life).

This method means that higher depreciation values are claimed earlier in the life of the asset, and lesser depreciation values later in the life of the asset.

This method provides a greater tax deduction and return to the investor up front, with deductions diminishing over time.

Prime Cost Method

The Prime Cost method of depreciation simply applies a consistent rate of tax depreciation to the starting value of the asset, so that it depreciates at the same value every year for the life of the asset.

For example, the prime cost depreciation rate for an asset expected to last 5 years is 20% of the original cost/value per year.

The formula for depreciation using the prime cost method is:

Asset’s cost X (days held/365) X (100%/asset’s effective life).

Note: “Days held” is the number of days you owned the asset in the income year in which you had it installed ready for use. Days held can be 366 for a leap year.

This strategy means a more consistent value of deductions and returns are achieved for the investor over the life of the property.

The following table illustrates and compares how the two methods work.

How does depreciation work on investment properties?

We all know our annual tax payable is calculated on our assessable income, which is our total income less our deductible expenses.

Property investors will be aware that most expenses incurred in holding their investment, such as interest on borrowings, repairs and maintenance and management fees, are claimable as tax deductions.

Depreciation is also a legitimate tax deduction and falls under two categories as shown in the table further below as “Division 43 Capital Allowances” and “Division 40 Depreciable Assets”.

Division 40:

Division 40 is the legislation that covers the depreciation of brand-new ‘plant and equipment’ within a residential investment property. Each plant and equipment item has an effective life set by the Australian Taxation Office (ATO) and the depreciation deduction available on that item is calculated using this effective life.

Division 43:

Otherwise known as ‘Capital Works Allowance’ or ‘Building Write-Off,’ Division 43 covers the deduction available to owners for the structural elements of a building and the items within the property that are deemed irremovable.

The beauty of depreciation is that it is a calculated written-down value, to account for the ageing of your building and its fixtures (assets you paid for already at purchase).

That means, unlike other deductions, you don’t have to spend additional money through the year in order to claim it back in your tax return.

Typically, the more depreciation you claim, the less tax you pay. Let’s look at the income, expense, and tax payable for a property with the following criteria:

Mortgage against property: $660,000

Interest rate at interest only: 5%

Rental income: $600.00 per week

Vacancy rate: 0%

As you can see from the table, by claiming Division 40 and 43 depreciation, the property investor’s annual deductions on the property increased over $14,000. For this client, that means an additional $4,589.23 in their pocket from a single tax return.

If you multiply the effect for returns claimed over future years, you can see how lucrative it can be for investors to claim their depreciation entitlements.

How do I get a depreciation schedule?

To ensure you are claiming the maximum allowable depreciation for your building and assets, the most effective and reliable way is to have our expert team produce an ATO compliant capital allowance and tax depreciation schedule for you. Our service includes:

- Property research

- Thorough inspection by a qualified assessor (on-site or online)

- Prime cost and diminishing value methods

- Missed deductions reported

- Split reporting

- Maximum deductions for historical work

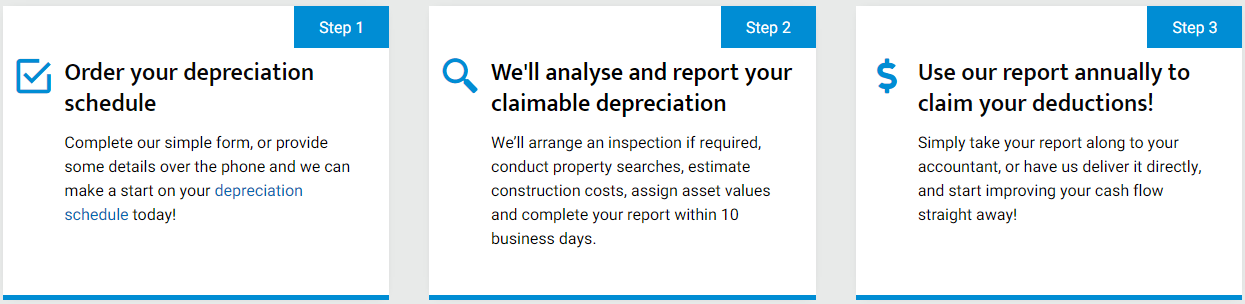

You can save thousands in three easy steps:

Benefits of a Tax Depreciation Schedule

A quality depreciation schedule offers numerous advantages:

- Maximising Returns: An expertly prepared depreciation schedule can enhance the financial appeal of your property investment, potentially turning a negatively geared property into one that generates positive cash flow.

- Non-Cash Deduction: Unlike many other property deductions, tax depreciation is a one-time expense. You can claim these deductions without spending additional money each financial year.

- Customised to Your Property: A depreciation schedule is customised to maximise all the benefits available to you, whether your property is brand new or established.

- User-Friendly: The schedule provides a clear breakdown of depreciation deductions each financial year for both capital works and plant and equipment assets.

When to Get a Depreciation Schedule

To make the most of your annual deductions, consider ordering a depreciation schedule as soon as possible. You are entitled to claim depreciation as soon as your property is available for rent.

Even if you haven’t owned your property for a full financial year, obtaining the depreciation schedule before the 30th of June allows you to qualify for partial deductions for that period, which allows you to claim in real-time.

Do I need a person to inspect my property?

For some properties, an inspection by a suitably trained and qualified inspector is still the best way to ensure all capital works and assets are properly captured for the benefit of maximising the tax deductions available to the owner.

We have also discovered that for many properties a virtual inspection, combined with comprehensive online research and client information is perfectly adequate for capturing all the necessary data, and ensuring maximum tax deductions are still claimed.

How much does a depreciation schedule cost and how long do they take?

Market fees for depreciation schedules can range from a few hundred dollars to over $700.

Our fee will depend on the type of property – commercial or residential, and whether the property is brand new or established, and how much information is available.

Our fees for brand new properties typically start from $440 (though discounts apply for clients of some large developers with bulk orders).

Our fees for established residential properties typically range from $590.00 to $690.00.

Your depreciation schedule fee is also 100% tax deductible!

What happens if I just found out about this? Can I redo my tax returns?

The ATO allows investors to make amendments for up to two years following their last Notice of Assessment date (the date on the letter they send to confirm your return/liability after they have processed your tax return). Individuals who are beneficiaries (or potential beneficiaries) of a Trust may be eligible to amend up to four years of returns.

This is great news for investors who may not have been aware of tax depreciation previously, or who failed to include it in their previous returns for some reason or another.

This typically results in a ‘bumper’ return for the client in the first year they claim depreciation, as previous years (with typically higher rates of deductions) are processed at the same time.

How many years can you depreciate a rental property in Australia?

These annual deductions commonly amount to thousands of dollars each year, providing investors with significant long-term financial benefits that can span up to 40 years, offering substantial tax savings over time.

How much will I save?

How much you will save we depend on what type of property you own. We can complete a free estimate of depreciation deductions for you and a personalised quote. This will help you make an informed decision about purchasing a depreciation schedule. Contact us on 1300 922 220.